Anticipating Winter: First Snowfall Forecast for 2025-2026

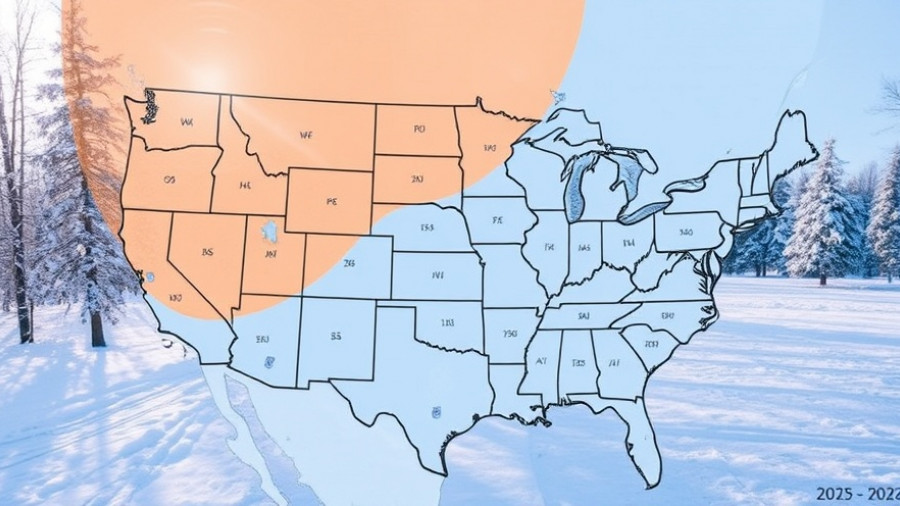

As the leaves begin to change and temperatures drop, the eagerly awaited First Snowfall Forecast for 2025-2026 hints at an early start to winter across much of the U.S. Meteorologists are employing advanced weather models and satellite data to provide a comprehensive breakdown, revealing that many regions may see their first snowflakes much earlier than usual.

What to Expect and When

This year’s forecast suggests that mountain regions could experience snow as early as late September, with the Midwest and Northeast anticipating snowfall before November. According to predictions, the Great Lakes and Northern Plains are likely to experience a colder and snowier season due to prevailing La Niña conditions and unusual jet stream patterns.

Residents in the northern U.S. can prepare for significant snowfalls as seasonal totals are projected to be notably high in regions such as:

- High Mountains/Rockies: Expect snowfall from late September to early October, accumulating 80-100 inches.

- Northern U.S. Plains: Snow is anticipated from mid to late October with moderate to heavy amounts.

- Midwest & Great Lakes: Snowfall is likely between late October and early November, providing between 70-90 inches, thanks to lake-effect snow.

- Northeast States: Early to mid-November will bring between 60-80 inches of snow.

- Southern Highlands: A light snowfall of 10-20 inches is expected from December to early January.

Understanding the Science Behind the Forecasts

Meteorologists are not just pulling numbers from thin air; they’re relying on a sophisticated blend of atmospheric data, including sea-surface temperatures and jet stream behavior. This year's outlook illustrates how La Niña, typically responsible for colder and wetter winters in the northern U.S., significantly influences snowfall patterns.

Dr. Laura Kenner, a senior climatologist, emphasizes the importance of these forecasts: "Seasonal forecasts don’t just predict snow; they help communities build resilience. A few weeks’ notice can make all the difference in road safety, crop protection, and energy planning."

Impacts of La Niña on Weather Patterns

The return of La Niña brings with it predictions of a stronger northern jet stream, which is expected to foster colder weather and deeper Arctic air incursion across the Midwest and Great Lakes. A significant shift in the polar jet stream could result in ideal conditions for early snow events, especially in the Central Plains and Northeast.

Local vs. Global Weather Considerations

While the 2025-2026 winter forecast offers valuable local insights, it’s also crucial to recognize the broader climatic trends at play. The National Oceanic and Atmospheric Administration (NOAA) has indicated that, while the northern Rockies and Great Lakes may encounter increased precipitation, southern regions face drier conditions, heightened by the ongoing influence of La Niña.

According to NOAA, the southern tier of the U.S. might experience warmer conditions, contrasting sharply with the cold snapshots forecasted for northern states. The variability underscores the unpredictable nature of winter weather across different regions.

Preparing for Winter: What You Can Do

With this forecast in mind, residents can take proactive measures to brace for the impending winter. Keeping tabs on local weather advisories and investing in home preparedness can go a long way. Farmers, commuters, and snow enthusiasts should pay particular attention, as the early arrival of snow may necessitate adjustments in logistics and daily activities.

As winter approaches, ensure safety through:

- Winter-proofing vehicles for icy conditions.

- Stocking up on food and supplies ahead of potentially severe weather.

- Staying informed about local forecasts to adapt plans accordingly.

As anticipation builds for the first snowflakes of the season, being equipped with the right knowledge and preparations can enhance both safety and enjoyment during the winter months.

Add Row

Add Row  Add

Add

Write A Comment